PRICING FACTORS:

| Options for Coverage Maximum: |

- Standard: $25,000, $50,000, $100,000 & $150,000

- Enhanced: $25,000, $50,000, $100,000 & $150,000

- Gold: $50,000, $100,000, $150,000 & $300,000

- Platinum: $50,000, $100,000, $150,000 & $300,000

|

| Deductible options available for savings(payable in Canadian Dollars): |

- $0 deductible

- $200 deductible reduces premium by 10%

- $500 deductible reduces premium by 15%

- $1,000 deductible reduces premium by 20%

- $2,500 deductible reduces premium by 25%

- $5,000 deductible reduces premium by 30%

- $10,000 deductible reduces premium by 40%

|

| Coverage Options: |

- Standard and Enhanced

- 0-74 years of Age has a standard stability 180 days with option to buy down to 90 days

- 75+ years of Age has a standard stability 365 days with option to buy down to 180 days or 90 days

- Gold and Platinum

- 0-74 years of Age has a standard stability 180 days with option to buy down to 90 days or 30 days

- 75+ years of Age has a standard stability 365 days with option to buy down to 180 days or 90 days or 30 days

*Dates are based from the departure from your home Country

|

| Age Restrictions: |

|

| Rate Information: |

- Rates based on age at booking.

- $15 minimum policy fee.

|

| Changes Prior to Effective Date: |

- Dates can be changed up until Effective Date

- Policies can be cancelled up until Effective Date

- No change or cancellation fees

|

| Refunds for Returning Early: |

- Subject to no claims being made against your policy

- Subject to a Administration Fee

- Must supply MQIB with Proof of Return

|

BENEFIT HIGHLIGHTS:

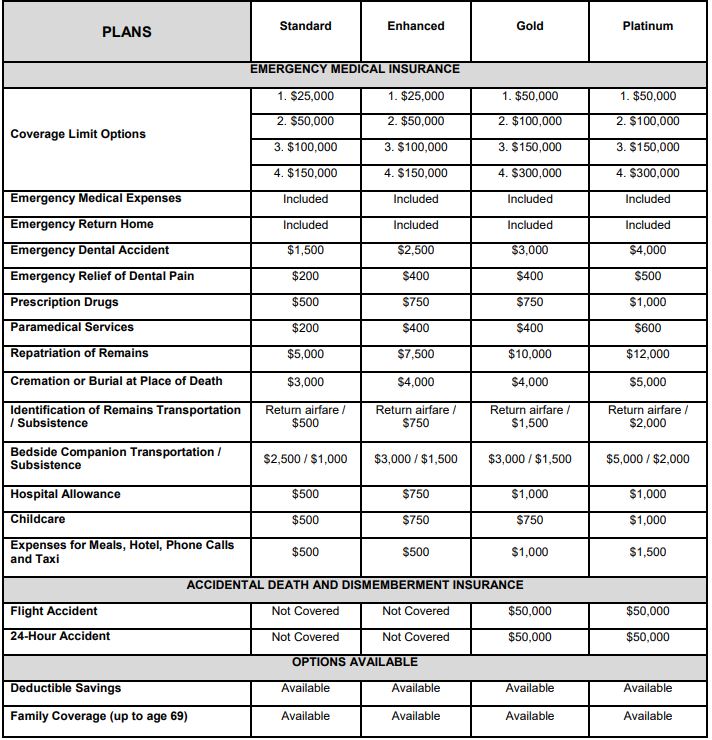

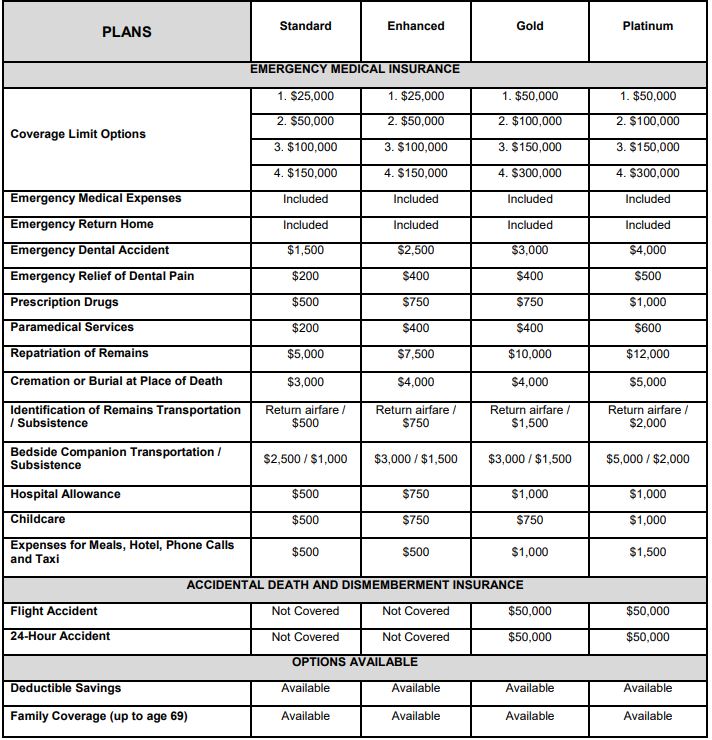

PLANS AT-A-GLANCE. Important: This chart provides a high level summary of overall maximum coverage limits. It is provided for Your convenience only. Be sure to read and understand all the terms and conditions of the policy (including Your policy Confirmation) before You travel, as Your coverage may be subject to certain limitations, exclusion and sub limits.

For a Full List of Benefits Click Here

| Emergency Medical Coverage: |

- For accidents, injury or sickness – coverage Includes ambulance transportation, hospital accommodation and care, diagnostic testing, physician and nursing services, surgery, medical supplies, equipment and medication

|

| Pre-Existing Medical Conditions: |

- Covered if your condition meets the “stable and controlled” requirements of the plan you qualify under for all of those benefits

|

| Repatriation of Remains: |

- If You die during Your Trip from an Emergency covered under this insurance, We will reimburse:

- Up to a maximum outlined below for expenses incurred for the preparation of Your remains and the cost of the standard transportation container normally used by the airline, plus the return Home of Your remains or ashes;

- Standard Plan – $5,000

- Enhanced Plan – $7,500

- Gold Plan – $10,000

- Platinum Plan – $12,000

- Up to a maximum outlined below for the cremation or burial of Your remains at the place of death.No benefit is payable for the expense of a headstone, casket, urn and/or funeral service.

- Standard Plan – $3,000

- Enhanced Plan – $4,000

- Gold Plan – $4,000

- Platinum Plan – $5,000

|

| Emergency Return Home: |

- Expenses for the use of an air ambulance or regularly scheduled airline to transport you back to your destination in Canada or your country of origin for further in-hospital treatment.

|

| Accidental Dental Coverage: |

- if you suffer an accidental blow to the mouth

- Standard Plan – $1,500

- Enhanced Plan – $2,500

- Gold Plan – $3,000

- Platinum Plan – $4,000

- if you require relief of dental pain

- Standard Plan – $200

- Enhanced Plan – $400

- Gold Plan – $400

- Platinum Plan – $500

|

| Please Note: |

- All benefits must be pre-approved by the insurance company by calling the phone number provided on the confirmation of insurance/Wallet Card provided upon the purchase of the policy.

- In an emergency and prior to seeking medical assistance it is extremely important that you call the insurance company assistance centre phone number located on your wallet card before seeking treatment, or as soon as you are physically able.

|

For a Full List of Benefits Click Here

- The Policy Wording has a full explanation of the benefits available and the exclusions as they apply to all travelers.

- We strongly recommend you take the time to read through it and let us know if you have any questions or concerns.

- The policy wording for this plan can be found under the policy documents section near the top of the page as well as the links below. We have linked each section to the specific page the the section starts on to make it easier for you.

|

- Beginning and End of Coverage – Starts on page 4 – Click Here

- Extensions – Starts on page 5 – Click Here

- Cancellation and Refunds – Starts on page 5 – Click Here

- Benefits – Starts on page 7 – Click Here

- Exclusions and Limitation – Starts on page 10 – Click Here

- Coordination with Other Insurance – Starts on page 15 – Click Here

- Claim information – Starts on page 15 – Click Here

- Definitions – Starts on page 16 – Click Here

|

Underwritten by Northbridge General Insurance Corporation

Premium in Canadian Dollars

Read your policy and know what you have purchased before you depart on your trip.

This page contains only a consolidated and summary description of all current benefits, conditions, limitations and exclusions. A Policy Document containing the complete Policy Wording with all terms, conditions and exclusions will be included in the fulfillment kit.

Your Best Insurance Plan Starts with Medi-Quote

We’re insurance brokers, which means we’ll shop around on your behalf to find the right plan for your specific needs at the best possible price. We aren’t tied to specific products or motivated by sales incentives, so it’s your best interests we serve. We’re available to you anytime, if you have questions or need assistance making a claim.